In our experience as contract compliance auditors, the answer to this question is unequivocally an advertiser’s failure to reconcile agency billing activity. Whether we’re talking creative services, digital production or media, advertisers are simply not vouching for the accuracy or completeness of either the agency’s or the 3rd party vendors billing efforts.

In our experience as contract compliance auditors, the answer to this question is unequivocally an advertiser’s failure to reconcile agency billing activity. Whether we’re talking creative services, digital production or media, advertisers are simply not vouching for the accuracy or completeness of either the agency’s or the 3rd party vendors billing efforts.

Given that “Estimated” billing remains the predominant form of agency billing to advertisers this lack of oversight creates tangible risks and the potential for financial loss that could be eliminated with the implementation of some fairly simple controls. These risks include the potential for billing errors to go undetected and aged credits, earned discounts and rebates not being returned to the advertiser and lost interest income opportunities tied to agency float.

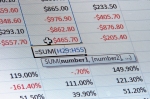

The principal stop-gap measure that could allay this problem is frequently overlooked by too many advertisers. What is that measure you ask? Simply requiring agencies to provide copies of all 3rd party vendor billing with their bill-to-client invoices.

In two recent examples, one in North America for a multi-channel direct marketer and one in the middle east for a pan-Arabian conglomerate, the client had put significant funds at risk, which had it not been for an independent audit, would surely have been lost. Each client was billed on an estimated basis by their agency, and each agency routinely failed to reconcile billing to actual expense. In both instances there were incremental agency remuneration activities identified that were not supported by the client/ agency agreements. These came chiefly in the form of AVBs, or volume-rebates, provided by media properties based on large expenditures made by each of the respective advertisers.

Had the requisite bill-to-client “back-up” data been available, client-side Accounts Payable personnel would have had the opportunity to review and challenge the billing and to secure financial true-ups along the way. Ironically, both advertisers had incorporate “Right to Audit” and “Document Retention” clauses into their agency agreements. However, as is typical across the industry, neither had previously enacted those clauses to engage an independent auditor to review the accuracy and timeliness of the agencies billing and 3rd party vendor payment processing efforts.

When advertisers take a lax posture on billing reconciliation and vouching, invariably two other areas are frequently impacted. The first represents a risk to the advertiser in the form of approved purchase order (P.O.) balances and earned, but not yet processed, credits being managed “off-book.” While these practices seem innocent enough on the surface and often involve client-side marketing personnel, the risks are very real. The notion is a simple one, the agency and client teams identify credits or unspent budgets and accrue these funds for future use on unexpected new initiatives or for planned projects that exceed budget. Harmless, right? Perhaps, until the client-side marketing representative is transferred out of their position or leaves the company altogether. This usually creates a knowledge gap that allows these “off-book” funds to remain undetected by the advertiser. Thus, in this scenario the agency is the only entity with knowledge that these funds even exist.

The second area impacted is an advertisers treasury management practices. With estimated billing, clients are often invoiced by their agency at the time of project approval, with payment due in 15 to 30 days. However, the agency may not be billed by 3rd party vendors until costs are actually incurred (i.e. calendar month following the month of service) and remittance may not be due for another 30 to 45 days. Finally, the agency may take an excessive amount of time to reconcile the vendor billing and hold off on processing payment until the charges are fully reconciled. While that all makes sense, the advertisers funds have been in the agency’s possession and not in an interest bearing account generating interest income for the advertiser.

Billing reconciliation is too important a task not to have a rigid oversight process and controls in place. Agencies handle anywhere from several dozen to thousands of 3rd party vendor invoices on the advertisers behalf. The sheer volume of billing activity can in and of itself create an environment that is ripe for mistakes. As noted twentieth-century American author Paul Eldridge once said;

“In the spider-web of facts, many a truth is strangled.”

Having a process that provides billing analysis redundancy makes good sense and will likely be welcomed by the agency. If you’re interested in learning more about independent billing reconciliation audit support, please contact Jim Bean, Principal at Advertising Audit & Risk Management at jbean@aarmusa.com for a complimentary consultation on this important topic.